Where to Find a Better Yield on Your Savings

- Daniel Czulno, CFP®

- Aug 4, 2021

- 5 min read

The purpose of your emergency fund savings is to be there when you need it, not generate return. Still, it would be nice if these funds kept up with inflation so that the dollars you save there today have the same buying power when the time comes that you need them.

Inflation, the Enemy of Cash

One of the biggest factors that keeps people from establishing and maintaining an emergency fund within the scope of their overall financial plan is the fact that this cash typically sits idle earning little to no interest. For individuals in this camp, seeing their cash earning next to nothing, while their investments seem to compound nicely over time, can create an urge to forgo maintaining any type of cash reserves. For individuals in this camp the desire to earn something can trump the desire to hold less risky assets.

On the other side though, are individuals who maintain significant cash balances of 6, 12, 18, or 24 months of cash reserves to provide liquidity and a level of protection against unforeseen risks to their financial journey. For folks in this camp one of the major enemies of their cash reserves is the quiet, sneaky, and (nearly) ever-present factor of inflation. While cash reserves help provide liquid assets to utilize when life is disrupted by unforeseen events, the buying power of these funds tends to decrease relative to the cost of covering the emergencies this fund is there to cover, due simply to the long-term effects of inflation.

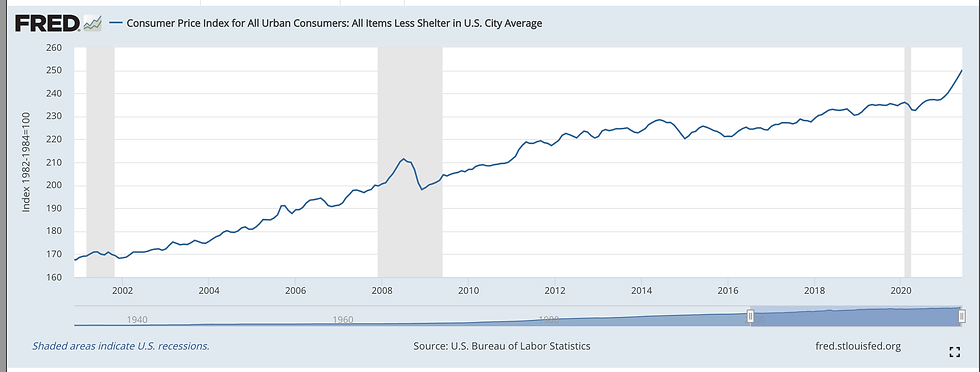

Below is an example of inflation via one measure in the Consumer Price Index report (CPI-U).

Source: St. Louis Fed (https://fred.stlouisfed.org/graph/?g=FQ7m)

The value of this index approximately twenty years ago was around 170, the value most recently stands at 250. Given this change, an individual or family with $50,000 in cash reserves in 2001, excluding any further deposits or interest, would still have that $50,000 in cash in 2021 but the relative buying power would be reduced to approximately $34,000 due to price increases because of inflation.

In simpler terms, this means if you set aside cash to protect against life’s risks, those risks tend to increase in cost over time even while your cash sits idle.

Tepid Interest on Savings

Traditionally, the answer to the problem of idle cash with zero-return has been to store these funds away in a savings account or certificate of deposit (CD) at your typical bank. It’s difficult to remember but there was actually a time that these products at a brick-and-mortar bank paid what might be considered respectable interest. Unfortunately, these days currently appear to be history.

More online savvy individuals may recall the shift over the past decade from brick-and-mortar banks to online banks which were able to tout their “high yield” savings and CDs at rates significantly higher than their physical banking rivals. In fact, it was not that long ago when a basic savings account at these online banks were available with a 2-3% yield and no minimum account balance. Even as the Federal Reserve began decreasing their headline rates and these online savings yields followed lower, online banks still tended to look like a great deal even at lower yields of 1.25-1.75%.

Over the past year, the environment has shifted significantly in many areas of life and yields on cash savings are just among one of the many areas that have been affected.

While online banks can still tout their significant multiple of 10x-50x the yields of their physical banking counterparts it’s only because these physical banks are offering yields at essentially 0% (0.01% to 0.05%, to be specific). Therefore, the current savings environment at online banks offering 0.40-0.50% yield is hardly inspiring and not enough to keep up with the Federal Reserve’s 2% inflation target, actual historical inflation rates as picture below, or high inflation readings lately which have overshot both the Fed’s target and recent historical rates though are currently being reported as simply “transitory.”

Source: St. Louis Fed (https://fred.stlouisfed.org/graph/?g=FQ7J)

A Solution in Savings Bonds

When I was a kid, my grandparents gave me what I thought was one of the greatest gifts at the time. When most cards came along with $5, $10, or maybe $20 bills tucked inside, they loved to hand me a US Savings Bond stamped with a face value of $100. I felt like the richest kid on earth at the time. Until I found out these were EE bonds which took decades to reach their face value and were intended to be tucked away until then. I went from feeling rich to feeling like all I got a worthless piece of paper, not an unfamiliar feeling to those who may hold cash in periods of high inflation.

Luckily for savers and those who want the safety of cash with the benefits of inflation protection, the US Treasury offers a different type of savings bond with some highly attractive features for a low interest rate environment in which inflation seems to tick higher, Series I Savings Bonds, or I Bonds for short.

I Bonds are an attractive solution to savings accounts because the yield an investor earns on these bonds is a composite rate which depends on two different components. The first component of the I Bonds yield is a fixed rate set at the time your bond is issued. The second component is a variable inflation rate which is updated every six months based on changes in the CPI-U reading in the Consumer Price Index reports.

Unfortunately, right now the fixed rate on new I Bonds is like the yields you can find elsewhere, 0.00%.

However, the power of I Bonds is not in their fixed rate, even though that’s a nice bonus when available. The real benefit of I Bonds is the inflation factor which updates every six months in line with recent inflation conditions. Additionally, the composite of these two rates has a floor of 0.00%. This means that at worst, which would be a period of deflation, these bonds will perform the same as cash. But, in any period where inflation is present, these bonds will aim to provide some inflation protection based on the readings from the CPI-U prior to the inflation factor updates each year in May and November.

For the first half of 2021, I Bonds have had a minimum composite annual yield of 1.68-3.54%, significantly better than high yield online savings accounts offering up to 0.50%.

There are a few factors to consider when utilizing I Bonds for your cash reserves, especially if this is savings set aside for an emergency.

You must hold your I Bonds for a least one year, so consider staggering your purchase dates.

If you sell your bonds within the first five years, the treasury will deduct the last three months of interest.

Each taxpayer is limited to $10,000 in I Bond purchases a year. Couples comprised of two US taxpayers are collectively eligible for $20,000 per year ($10,000 each)

I Bond purchases are only available through the Treasury’s website TreasuryDirect.gov. The bonds can’t be held at your brokerage or local bank.

You can pay tax on your accrued interest each year or defer until the bond is cashed.

Thinking Outside The Bank

I’ve seen many people move from bank to bank in search of a slightly higher rate on the cash reserves they desire to keep on hand. I’ve also seen folks stretch for yield by increasing the risk and volatility of their cash reserve with investments.

While savings bonds are not the type of investment which typically garners the attention of those seeking quick returns, it may just be the boring nature of this investment vehicle which could potentially make it an asset worth considering to supplement your emergency savings.

Comments